Every financial system in the world relies on the currencies used for transacting. In the crypto world, tokens represent currencies transacted under that specific ecosystem. It’s crucial to find a fast and secure way to transfer these tokens across the Blockchain network. And this is where cross-chain transfers steal the spotlight.

This article, brought to you by LI.FI we’ll define cross-chain token transfers and analyzing possible challenges closely following these events. Here we go!

Before diving into the nitty gritty of cross-chain transfers, we must first understand the main characters of the story.

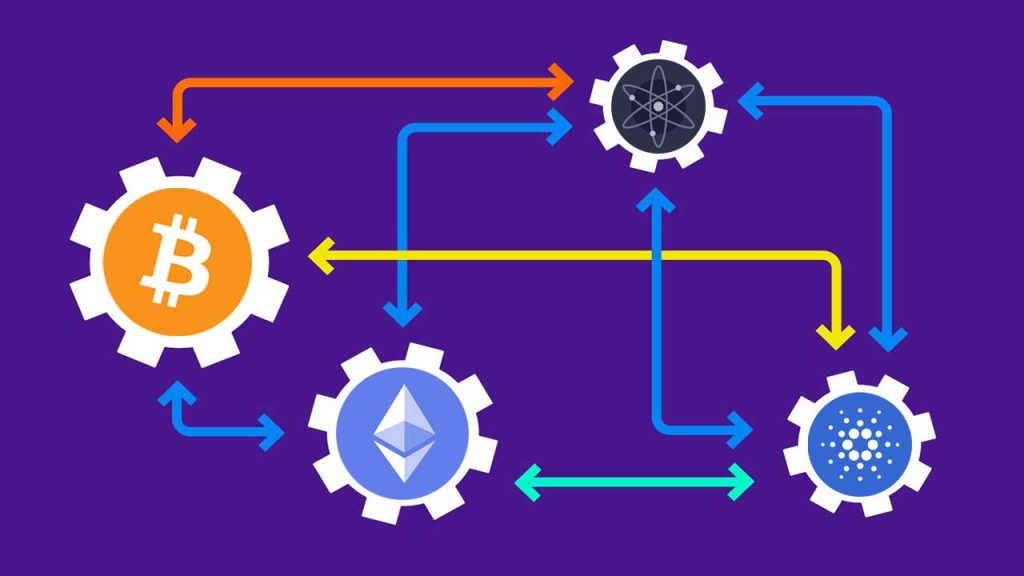

Tokens are digital assets or units of value created to serve a specific Blockchain platform. These tokens can represent various things including stake in a company to a unit of currency. Moving tokens from different chains means transferring them from one Blockchain to another. Mind you, this is not as straight forward as you might think, each Blockchain has a unique protocol, rules, and structures. Classification of bridges plays an important role here, as different bridges offer different functionality in chain connectivity.

One of the challenges faced while moving tokens across different chains is the lack of a unified standard. Most blockchains operate under a distinct consensus mechanism with varying costs and speed involved. Ensuring different blockchains are compatible between diverse systems is a complex task.

Another major challenge is security. Cross-chain transactions often increase the risk of vulnerable attacks including the dreaded ‘double-spending’ problem, this is where the same token gets spent more than once. It’s important to ensure and guarantee integrity and security across different blockchains during cross-chain transactions.

Liquidity is also a major concern meaning tokens moved across different blockchains need to be ready for conversion and still maintain their value. And this is a major challenge especially due to the fluctuating and volatile aspect of crypto markets.

To help address these challenges, there are various solutions developed to ease cross-chain transactions undertakings. These include use of cross-chain bridges. These are protocols allowing efficient transfer of tokens between different Blockchain networks. The protocols work by locking tokens to one chain while using equivalent tokens on the other chain. By doing this, the protocols ensure the total supply remains constant.

Development of interoperable Blockchain protocols is another solution developed to tackle cross-chain transaction problems. These are protocols that facilitate the communication and transfer of tokens on different Blockchains. The protocols move to create a seamless environment where tokens move freely across networks without compromising security or speed.

Blockchain interoperability platforms are increasingly gaining traction. The transactions offer a unified layer for different blockchains to interact with each other thereby enabling token transfer without needing custom bridges or protocols for each pair of Blockchain used.

You must first understand the importance of cross-chain interoperability. Imagine living in a world where credit card readers only read from a single brand. This means customers using another brand won’t make store payments. And what about having different machines that support each card reader?

That isn’t suitable for everyone, is it?

And this is where lack of interoperability in Blockchain can cause similar problems. Thankfully, a cross-chain interoperability addresses these concerns and others’

Different blockchains offer different features and network strength. Once two different blockchains communicate effectively, it makes it easier for users to go for the best Blockchain rather than locking themselves into a single Blockchain with one-size-fits-all approach.

Cross-chain interoperability does help increase liquidity in the crypto market. It helps with market movement as assets freely move without any hurdles enabling traders to invest across different markets. It helps traders avoid market-specific economics that would hinder transactions.

It also helps foster innovation by allowing developers combine different features and functionalities. This helps address new hybrid solutions that were otherwise impossible on a single chain.

With the Blockchain ecosystem growing, it helps users engage with multiple blockchains. It’s imperative these chains work together to create a more seamless user experience that enables mainstream adoption.

Different developers have come up with several ground-breaking solutions to cross-chain interoperability challenges. All of these approaches help facilitate and mitigate transactions across different Blockchains. This means users don’t have to rely on centralized intermediaries or unknowingly create security vulnerabilities.

Here are some of the most popular cross-chain token interoperability approaches;

These are one of the most common mechanisms used to achieve cross-chain interoperability. Some of the tokens used can lock up assets on one chain while issuing the equivalent token number on the other without getting burned or locked up.

Nodes that communicate between blockchains are what’s referred to as relays. As the name suggests, thy relay important information such as confirmations and proofs from one chain to another. These relays ensure actions taken from one token Blockchain to another. Performance on these relay-based token cross-chain are solely based on the chain’s consensus.

These are third-party trustees that forward and verify cross-chain token transactions. A single signature approach is straightforward, it however involves a high level of centralization. That’s why many Blockchain token platforms leverage multi-signature approach requiring multiple consensus among notaries to sign and verify transactions.

Harsh-time locks initiates Blockchain where the token-ecosystem chooses a number randomly and sending it to the receiving Blockchain. It involves computing the hash-value and sending it to relevant token Blockchain for verification. By doing this, a token or smart contract unlocks both transactions with the hash algorithm used to complete the entire transaction or trade.

There are several cross-chain interoperability known to the public where others are yet to gain traction. Let’s take a closer look at some of these examples

CCIP or what’s commonly referred to as Cross-Chain Interoperability Protocol is the most popular open standards used for token cross-chain transfers.

It helps transfer of messages and tokens between different blockchains. This cross-chain network wraps tokens of one Blockchain and mints them to the other Blockchain.

It provides a secure way of moving tokens from one Blockchain to another without trusting a centralized intermediary.

It acts as a central ledger for compatible blockchains referred to as zones. The cross-chain uses a defined Interchain Standard to set defined token functions.

Moving tokens across chains is without a doubt unavoidable when building bridges in the digital world, especially when connecting separating different blockchains. This journey was met with challenges, and continues to offer robust security while maintaining the liquidity of tokens. There are various solutions emerging from the crypto community which are effective and innovative. From having interoperable to specialized protocols, these solutions are solving today’s problems while laying the foundation for a more connected, secure, and versatile Blockchain future.

As the technologies mature, they promise to create a safe environment making every cross-chain token transaction fast, free, and transparent.

Want to invest in Cryptocurrency? Check out these passive income projects involving tokens.

Do leave a comment or email us with any queries.

0 Comments