The subsidiary of Raiffeisen Bank, based in Austria is preparing to allow its clients to trade Bitcoin starting in early 2024. The bank has rolled out its ambitious crypto plans for 2024 as a part of the wider effort to accommodate the needs of clients using crypto and expanding its services.

In recent months Crypto and Bitcoin news were mostly focused on traditional financial institutions accepting Bitcoin and other currencies and large banks quickly followed along. It goes to show the broader change in attitude towards crypto that’s been in the works for a while now.

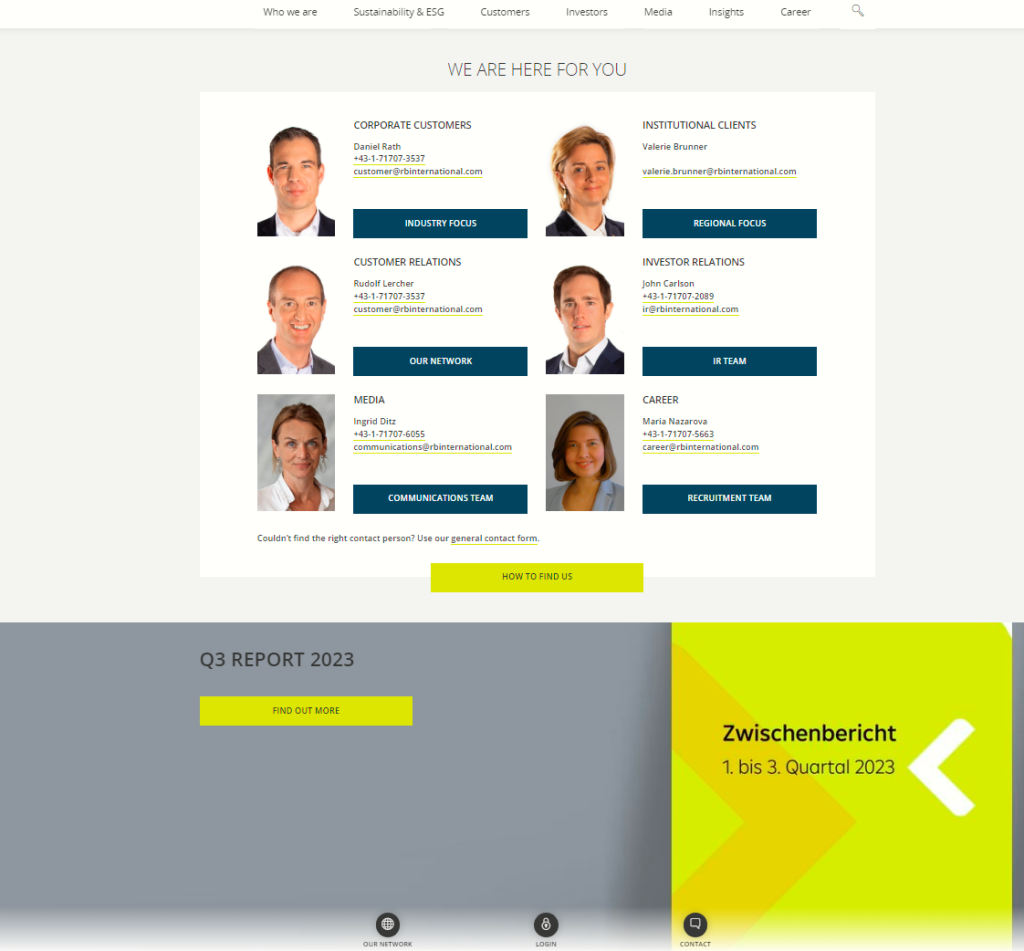

Raiffeisen Bank’s Raiffeisenlandesbank Niederösterreich-Wien (RLB NÖ-Wien) has announced a cooperation with an Austrian crypto firm called Bitpanda in order to allow its clients to trade Bitcoin.

“Raiffeisenlandesbank NÖ-Wien has signed a cooperation agreement with Bitpanda. Via this cooperation, we plan to offer an attractive digital investment platform early in 2024,” the representative stated, adding:

We have seen the demand from customers for easy, intuitive, digital investment platforms. Our main intention to take customer-centric decisions has triggered these efforts, which we are excited about bringing to market.”

Since the new crypto features are offered via Bitpanda, Raiffeisen users will have access to all the cryptocurrencies that Bitpanda has to provide. Bitpanda trades with over 2.500 different cryptocurrencies including the biggest ones such as Bitcoin and Ethereum.

“As we announced in April, the end goal is to make our offer available to all RLB NÖ-Wien customers. However, the rollout will begin with their customers in Vienna,” a spokesperson for Bitpanda noted.

Raiffeisen has announced that crypto trading will be available to all customers including retail, private banking, and corporate customers.

This news is important for a broader audience than just Raiffeisen clients. Cryptocurrencies are now widely accepted by users from all over the world and are used as a payment method in almost every industry. They have been volatile but in the broader sense crypto has proven to be a safe investment.

The recent adoption has led traditional financial institutions to be more open towards crypto and banks are among them. In turn, it has also led to stricter regulation and more government oversight. It’s a bittersweet moment for crypto enthusiasts now that they are widely accepted, but the industry is less free in general.

Raiffeisen users will be able to use all the services that Bitpanda provides. This means they will be able to buy and sell cryptocurrencies for both other crypto and fiat currencies. The bank will charge a fee for this service as does the crypto exchange.

These transactions are safe and easy to execute even if you’re a novice in the world of crypto trading. The changing value of cryptocurrencies can be tracked daily and even from one moment to another by using a mobile device only.

The users won’t need to install any new apps and instead, the exchange is open and accessible through the existing Raiffeisen Bank app, the users are familiar with.

“The experience will be familiar, so confirming a trade will work exactly like an account-to-account bank transfer with the same sort of security customers are used to,” said Curt Chadha, the bank's head of innovation.

At first, the innovation will target small-scale trades and users who are already tech-savvy.

Raiffeisen Bank is one of the oldest banks in Europe. It was founded in 1886 by Friedrich Wilhelm Raiffeisen. The bank was a pioneer of the cooperative model of banking. It weathered economic challenges, including the Great Depression and two World Wars, proving the resilience of its cooperative structure.

As of 30 June 2023, the Raiffeisen Group had 247 billion Swiss francs ($280 billion) in assets under management and 219 billion CHF ($248 billion) in client loans. Raiffeisen Bank AG's annual revenue for 2022 was $12.523B, which is a 58 percent increase from the previous year.

Bitpanda is a cryptocurrency exchange founded in 2014 by Eric Demuth, Paul Klanschek, and Christian Trummer in Vienna, Austria. The company was first known as Coinimal and it changed the name in 2016. The valuation of Bitpanda is somewhere over $1.3 billion or at least it was before the Raiffeisen Bank announcement.

The company has a yearly net profit of over 37 million Euros after taxes and this is after a few bad years for crypto- the so-called crypto winter of 2022. It has over 4 million active users and a team of more than 700 employees. Bitpanda users also trade in precious metals and stocks.

Raiffeisen Bank isn’t the first one opening up to the possibilities of cryptocurrency trading. Many traditional banks are seeing this as an opportunity. The biggest banks that allow cryptocurrency trading are JPMorgan Chase, Bank of America, Mitsubishi UFJ Financial Group, HSBC, and BNP Paribas.

At the same time, Chinese and Asian banks in general are still very conservative towards cryptocurrencies and they are not allowing users to trade in crypto. The top four banks in the world: ICBC, China Construction Bank, Agricultural Bank of China, and Bank of China are considered to be non-friendly towards crypto.

When it comes to traditional financial powerhouses accepting cryptocurrencies, it’s not all about banks, stock markets, and financial institutions. Sometimes, the signs that the general attitude towards crypto is moving to greater acceptance are symbolic changes. One of those happened just a few weeks ago.

Ferrari started accepting payments in crypto, with the help of BitPay, a major cryptocurrency payment company. At this point, the purchases can be made in 10 locations in the US only. It’s believed that moves such as these have had an effect on banks and their new liberal attitude towards crypto.

One of the biggest steps towards mainstream adoption came just before the Raiffeisen announcement. Bitcoin created its own ETF coin as a response to the creation of a similar asset by Ethereum. Cryptocurrencies can’t be traded on the stock market, but ETFs (exchange-traded funds) provide a way for investors to own a piece of a company that creates crypto coins, instead of owning the coins outright.

This means that the investors will be able to trade in crypto the same way they would with any other traditional financial asset, such as a stock or a bond. The investors own a portion of a company behind it and get paid dividends based on its growth.

A branch of Raiffeisen Bank based in Austria has announced that it will allow trading in crypto starting in 2024. The bank is doing so by collaborating with Bitpanda, an Austrian crypto exchange. The bank will allow users to buy and sell crypto using its app.

This move comes just after a few other traditional companies have allowed payments in crypto – Ferrari just recently announced that their cars could be bought using crypto and Bitcoin created a financial product that can be traded in traditional stock exchange. Banks and traditional financial institutions are therefore showing an increased interest in crypto and consider it a safe investment.

Want to learn more about Crypto tools, and find out which are performing exceptionally in the market?

Do leave a comment or email us with any query.

0 Comments